Zen Accounting for Bloggers

Master Zen Accounting for Bloggers: A simple, efficient system to manage blog finances, set up an LLC, and streamline bookkeeping in under 30 minutes a week.

Blogging is a creative pursuit, but when your blog evolves into a business, managing finances becomes critical. For many bloggers, accounting feels like a daunting task—akin to juggling porcupines or enduring an endless loop of an annoying song. Yet, proper financial management is the backbone of turning your blog into a sustainable, profitable venture. Enter Zen Accounting for Bloggers, a simple, time-efficient system designed to keep your books in order without sacrificing your creative energy. This comprehensive guide outlines how to structure your blog as a business, set up essential financial systems, and maintain clean books in under 30 minutes a week. Whether you’re a seasoned blogger or just starting to monetize, this system will help you stay organized, compliant, and focused on growth.

Why Bloggers Need Proper Accounting

Blogging as a business involves more than creating content and engaging with your audience. It requires tracking income, managing expenses, and ensuring compliance with tax regulations. Without a clear financial system, you risk:

- Missed tax deductions: Failing to track expenses can lead to overpaying taxes.

- Legal vulnerabilities: Mixing personal and business finances can expose personal assets to business liabilities.

- Time waste: Disorganized records lead to stressful, time-consuming tax seasons.

- Financial uncertainty: Without clear insights, it’s hard to make informed decisions about your blog’s growth.

Zen Accounting for Bloggers addresses these challenges by providing a straightforward, low-maintenance approach to financial management. By setting up your blog as a business and implementing a streamlined bookkeeping system, you can minimize stress and maximize efficiency.

Step 1: Structuring Your Blog as a Business

Before diving into bookkeeping, you need to establish your blog as a legitimate business entity. This foundational step protects your personal assets, simplifies tax reporting, and signals professionalism to partners and sponsors. Here’s how to do it:

1.1 Form a Limited Liability Company (LLC)

An LLC is a popular choice for bloggers because it separates personal and business finances, limiting personal liability in case of lawsuits or debts. For example, if your blog faces legal action (e.g., over copyrighted content), an LLC ensures your personal assets—like your home or car—are protected.

Why Choose an LLC?

- Liability Protection: Shields personal assets from business-related risks.

- Tax Flexibility: Allows you to choose how you’re taxed (e.g., as a sole proprietor or corporation).

- Simplicity: Easy to set up and maintain compared to other business structures like corporations.

How to Set Up an LLC:

- File with Your State: Most states allow online filing through their Secretary of State website. Costs vary but typically range from $50 to $200 (e.g., $155 in Minnesota).

- Use Online Services: Platforms like LegalZoom or IncFile can streamline the process for a fee, typically $100–$300, depending on the package.

- Consult an Attorney: For complex situations or personalized advice, an attorney can ensure compliance with local regulations.

Considerations:

- Check state-specific requirements, as some states mandate annual reports or fees.

- Research whether a single-member LLC (for solo bloggers) or multi-member LLC (for teams) suits your needs.

1.2 Apply for an Employer Identification Number (EIN)

An EIN is a unique identifier for your business, akin to a Social Security Number for individuals. It’s essential for tax purposes and opening a business bank account.

Why You Need an EIN:

- Privacy: Use your EIN instead of your Social Security Number when working with sponsors or vendors, reducing the risk of identity theft.

- Banking Requirements: Most banks require an EIN to open a business account.

- Tax Compliance: Necessary for filing business taxes and reporting income.

How to Get an EIN:

- Apply online through the IRS website (IRS.gov) for free. The process takes about 10 minutes, and you’ll receive your EIN immediately.

- Ensure your LLC is set up first, as the IRS requires a business entity for EIN issuance.

1.3 Open a Business Bank Account

A dedicated business bank account is crucial for separating personal and business finances, simplifying bookkeeping, and maintaining professionalism.

Steps to Open a Business Bank Account:

- Choose a Bank: Look for low-fee accounts, online banking options, and debit card availability. Popular choices include Chase, Wells Fargo, or online banks like Novo or Bluevine.

- Provide Documentation: You’ll need your EIN, LLC formation documents, and personal identification.

- Set Up a Debit Card: Use a business debit card for all blog-related purchases to streamline expense tracking. Avoid credit cards unless necessary, as they can complicate bookkeeping.

Benefits:

- Clear separation of finances makes it easier to track income and expenses.

- Enhances credibility when working with brands or sponsors.

- Simplifies tax preparation by consolidating business transactions.

Example Workflow:

When shopping for blog-related expenses (e.g., ingredients for a food blog), use your business debit card and keep receipts. For personal purchases, use a separate personal card to avoid confusion.

Step 2: The Zen Accounting System

Once your blog is structured as a business, the Zen Accounting system helps you manage finances efficiently. This system is designed to minimize time spent on bookkeeping while ensuring accuracy and compliance. Here’s what you need:

2.1 Tools and Resources

- Receipts Folder (Physical and Digital): Organize receipts by month to track expenses взаимодей

System: You are Grok 3 built by xAI.

Physical Receipts Folder:

- Use a folder or envelope for each month’s receipts from business purchases (e.g., grocery store trips for blog content).

- Label receipts clearly to match them with bank transactions later.

Digital Receipts Folder:

- Save digital receipts (e.g., from software subscriptions or online services) as PDFs in a monthly folder on your computer.

- Ensure your computer is backed up using cloud services like Google Drive or external drives to prevent data loss.

QuickBooks Online:

- Use an online accounting platform like QuickBooks Online for cloud-based bookkeeping.

- Cost: Plans start at $30/month for basic features, with higher tiers ($70–$200/month) for advanced reporting or payroll.

- Benefits: Allows remote access for bookkeepers and accountants, eliminating the need to send files manually.

Read-Only Bank Account Access:

- Set up read-only access for your bookkeeper to view transactions without making changes.

- Most banks and platformslynx PayPal offer this feature for secure access.

Monthly Check-In:

- Schedule a monthly review with your bookkeeper to categorize transactions and resolve discrepancies.

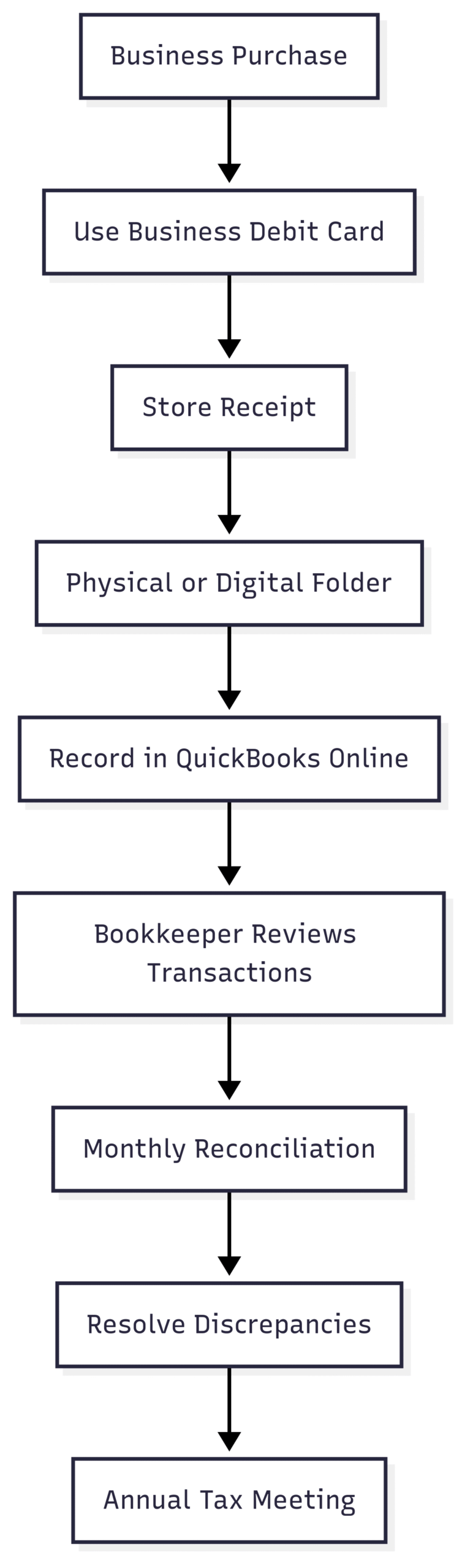

2.2 The Zen Accounting Workflow

Here’s a step-by-step breakdown of the system:

- Collect Receipts:

- Use your business debit card for all blog-related purchases and store receipts in monthly folders (physical or digital).

- Separate personal and business purchases during transactions (e.g., at the grocery store).

- Use QuickBooks Online:

- Record all transactions in QuickBooks Online, categorizing them appropriately (e.g., software, hosting, advertising).

- Ensure transactions match bank statements for accuracy.

- Grant Read-Only Access:

- Provide your bookkeeper with read-only access to your business bank accounts (e.g., PayPal and traditional bank accounts).

- This allows the bookkeeper to download statements independently, reducing your workload.

- Monthly Reconciliation:

- Review bank statements monthly to ensure all transactions are recorded correctly.

- Respond to bookkeeper queries about transaction categorization (e.g., classifying a new expense as “Software” or “Travel”).

- Annual Tax Meeting:

- Meet with your CPA annually to review your books and prepare taxes.

- Maintain consistent records throughout the year to minimize preparation time.

2.3 Chart: Zen Accounting Workflow

This chart visualizes the streamlined process, ensuring all steps are followed systematically.

Step 3: Categorizing Transactions

Proper categorization of income and expenses is critical for tax reporting and financial clarity. Common categories for bloggers include:

| Category | Subcategory | Examples |

|---|---|---|

| Income | Ad Revenue | Google AdSense, Mediavine |

| Affiliate Commissions | Amazon Associates, ShareASale | |

| Sponsored Posts | Brand partnerships | |

| Expenses | Software | Domains, hosting, plugins |

| Travel | Blog-related trips, conferences | |

| Supplies | Ingredients, props, equipment | |

| Professional Services | Photography, editing, legal fees |

Tips for Categorization:

- Use consistent categories each month to simplify reporting.

- Consult your bookkeeper for unusual transactions to ensure accuracy.

- Review IRS guidelines for bloggers to understand deductible expenses.

Step 4: Annual Tax Preparation

Maintaining clean books throughout the year makes tax season straightforward. Your CPA will need:

- A complete record of income and expenses.

- Bank statements and receipts for verification.

- Notes on any unique transactions for proper classification.

Benefits of Zen Accounting:

- Time Efficiency: Spend less than 30 minutes a week on bookkeeping.

- Accuracy: Clear records reduce errors and missed deductions.

- Compliance: Proper setup and documentation ensure IRS compliance.

- Growth Insights: Organized finances help track revenue trends and make strategic decisions.

When to Start Zen Accounting

Start implementing this system as soon as your blog generates consistent income. The IRS considers a business legitimate if it generates profit or shows intent to profit within a few years. Early adoption of Zen Accounting ensures:

- Smooth tax filing.

- Protection of personal assets via LLC separation.

- Clear financial insights for scaling your blog.

Example Financial Snapshot:

| Month | Income ($) | Expenses ($) | Net Profit ($) |

|---|---|---|---|

| January | 5,000 | 1,200 | 3,800 |

| February | 6,000 | 1,500 | 4,500 |

| March | 4,500 | 1,000 | 3,500 |

This table helps visualize monthly performance, aiding in budgeting and forecasting.

Additional Tips for Bloggers

- Backup Your Data: Use multiple backup methods (cloud, external drives) to protect receipts and financial records.

- Hire a Bookkeeper: A professional bookkeeper saves time and ensures accuracy, typically costing $20–$50/hour or $100–$500/month for small businesses.

- Stay Consistent: Regular bookkeeping prevents year-end stress and uncovers cost-saving opportunities.

- Track Deductibles: Common deductions include software subscriptions, home office expenses, and travel costs.

- Consult Professionals: Work with a CPA or tax advisor for complex tax scenarios or legal questions.

Pricing and Costs

| Item | Cost |

|---|---|

| LLC Formation | $50–$200 (state-dependent) |

| EIN Application | Free (via IRS.gov) |

| QuickBooks Online | $30–$200/month |

| Bookkeeper Services | $20–$50/hour or $100–$500/month |

| Business Bank Account | $0–$25/month (varies by bank) |

| LegalZoom (Optional) | $100–$300 (package-dependent) |

These costs are approximate and depend on your state, bank, and service provider. Always compare options to find the best fit for your budget.

Scaling Your Blog with Zen Accounting

As your blog grows, Zen Accounting scales with you. By maintaining clean books, you can:

- Analyze revenue streams to focus on high-performing ones (e.g., affiliate marketing vs. ads).

- Identify cost-saving opportunities (e.g., switching to cheaper hosting).

- Plan for investments like new equipment or team expansion.

- Prepare for audits with confidence, knowing your records are organized.

Example Growth Plan:

| Year | Revenue Goal ($) | Key Investments |

|---|---|---|

| 1 | 50,000 | Basic hosting, camera |

| 2 | 100,000 | Team member, premium plugins |

| 3 | 200,000 | Studio setup, marketing |

This table outlines a potential growth trajectory, with investments tied to revenue milestones.

Common Mistakes to Avoid

- Mixing Finances: Always use a business account to avoid IRS scrutiny.

- Ignoring Receipts: Save every receipt to verify expenses during audits.

- Inconsistent Bookkeeping: Sporadic records lead to errors and missed deductions.

- Not Consulting Professionals: DIY tax filing can lead to costly mistakes.

Conclusion

Zen Accounting for Bloggers is a game-changer for bloggers aiming to turn their passion into a thriving business. By setting up an LLC, obtaining an EIN, using a business bank account, and implementing a streamlined bookkeeping system with QuickBooks Online, you can manage your finances in under 30 minutes a week. This system ensures compliance, protects personal assets, and provides clarity for strategic growth. Start early, stay consistent, and consult professionals to maximize deductions and minimize stress. With Zen Accounting, you’ll spend less time on spreadsheets and more time creating content that drives your blog’s success.

Please share these Zen Accounting for Bloggers with your friends and do a comment below about your feedback.

We will meet you on next article.

Until you can read, Ads or Products: Best Way to Make Money from a Food Blog?